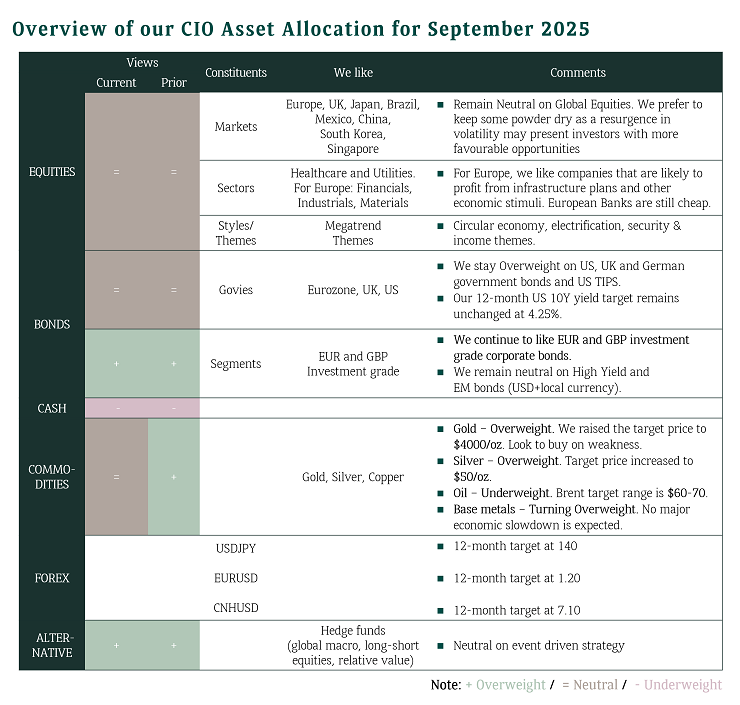

This edition of the Investment Navigator for September 2025 discusses how investors should position ahead of the potential policy pivot from the Fed in the upcoming September FOMC meeting. We expect the Fed to resume the rate cut cycle from September with a quarterly 25bp cut until mid-June 2026 with terminal rate at 3.5%.

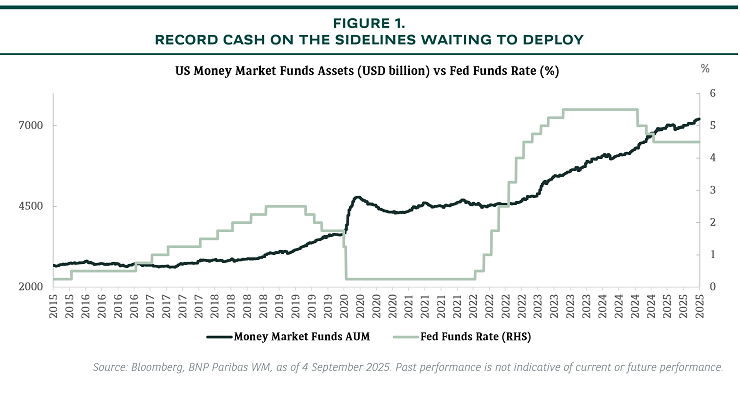

With record cash on the sidelines, we expect the favouable market conditions would drive cash into asset markets for better returns in the coming months and quarters. We also address question on whether the equity markets are getting irrational and the worry of market bubble.

Fed rate cut in September is almost a done deal

In the US, the recent weaker than expected job data while in-line inflation numbers have reinforced market expectations of a 25 bp cut in September. Fed Chair Powell also opened the door for rate cut this month in his Jackson Hole speech, saying economic outlook “may warrant” change in stance as the labour market might be softening enough to rein in inflation that is being pushed up by tariffs. We continue to expect Fed rate cuts in September and December this year, and another two cuts next year, with a terminal rate of 3.5%.

Record cash on the sidelines

Attractive yield and tariff uncertainty have driven USD 360 billion net inflows to the US money market funds YTD, with total assets under management now surpassing a record USD 7 trillion. With the Fed resuming the rate cut cycle, this would imply lower returns from cash (deposits and money market funds). Hence, it is reasonable to assume more cash would be deployed to equity and bond markets to get better potential rewards, especially if asset markets continue to show resilient returns. Other factors that would support cash deployment are: (1) financial conditions continue to ease which are tailwinds for asset markets; and (2) recession risk remains low as the Fed seems to be quick in responding to weaker job market and see tariff-induced inflation as a one-time jump in prices.

Are equity markets getting irrational?

A number of equity markets globally hit record highs or witnessed multi-year breakouts recently. Some investors start to worry about market bubble forming especially in the US equities as valuations are relatively expensive. First of all, equity markets still look rational as earnings have been taking the driving seats. Stocks and sectors that have outperformed YTD are also winners in earnings growth. On the contrary, those stocks and sectors with weaker earnings have underperformed.

Secondly, history suggests market bubble usually bursts when the Fed tightens, but now, the Fed looks set to cut interest rates. Thirdly, past experience shows that a sharp decline in US equities is either driven by a US recession or Fed rate hikes, but it seems both are not happening at least in the near term.

Seasonality shows September tends to be the weakest month for US equities. As so much cash is sitting on the sidelines waiting to deploy, we may not see a deep correction. Nevertheless, any pullbacks are buying opportunities as market conditions are favourable for a year-end rally. We are already neutral global equities favouring Non-US vs. US equities.

Dollar to weaken & precious metals to shine further

Many central banks globally have been cutting rates this year while the Fed paused. Going forward, the rate cutting cycle for some central banks may be coming to an end or near the end, while the Fed may just resume its rate cut cycle. This would mean narrowing interest rate differentials which tend to be less favourable for the dollar. We expect further dollar weakness in the medium term. Our 12-month target for the USD Index is 95 (currently 98).

Lower interest rate environment tends to benefit non-yielding assets such as gold and silver. We remain bullish on precious metals. Our 12-month targets for gold is $4000 and silver is $50.

Positioning for Fed rate cuts

- Stay invested and stay diversified

- Put cash to work

- Lock in higher yields from bond exposure when yields rebound

- Buy on dips on equities and precious metals

- Diversify to non-USD currencies when USD rebounds

- Engage in hedge funds strategies

- Consider “deposit/cash alternatives” – structured solutions linked to different asset classes that offer limited downside risk while getting coupons from participating in market upside.